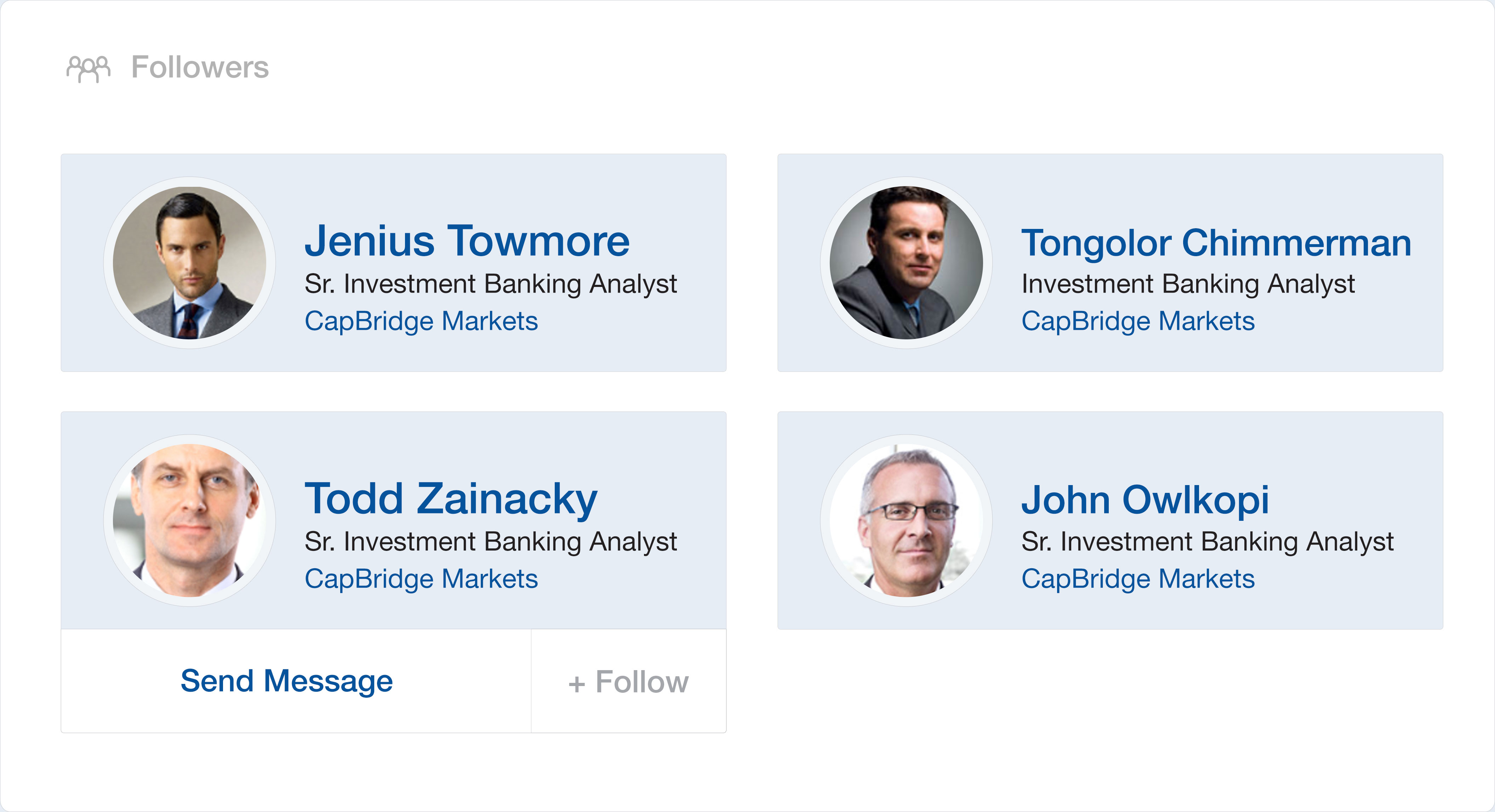

1.Create Online Profile

Create your online profile and provide your investment criteria. Start

connecting and engaging with companies, and keep up-to-date with

companies of interest.

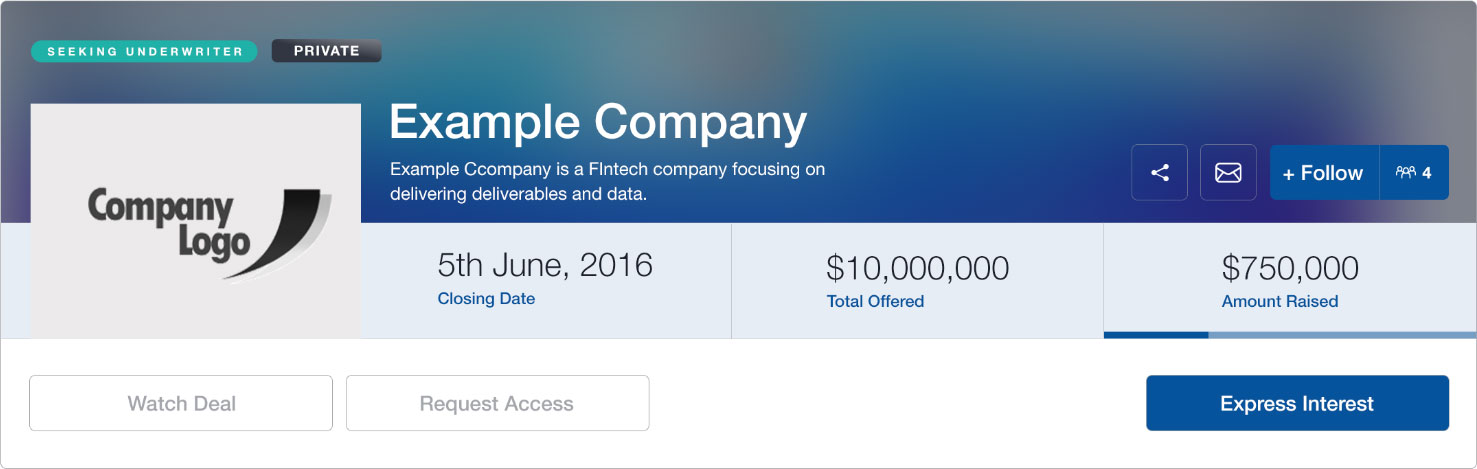

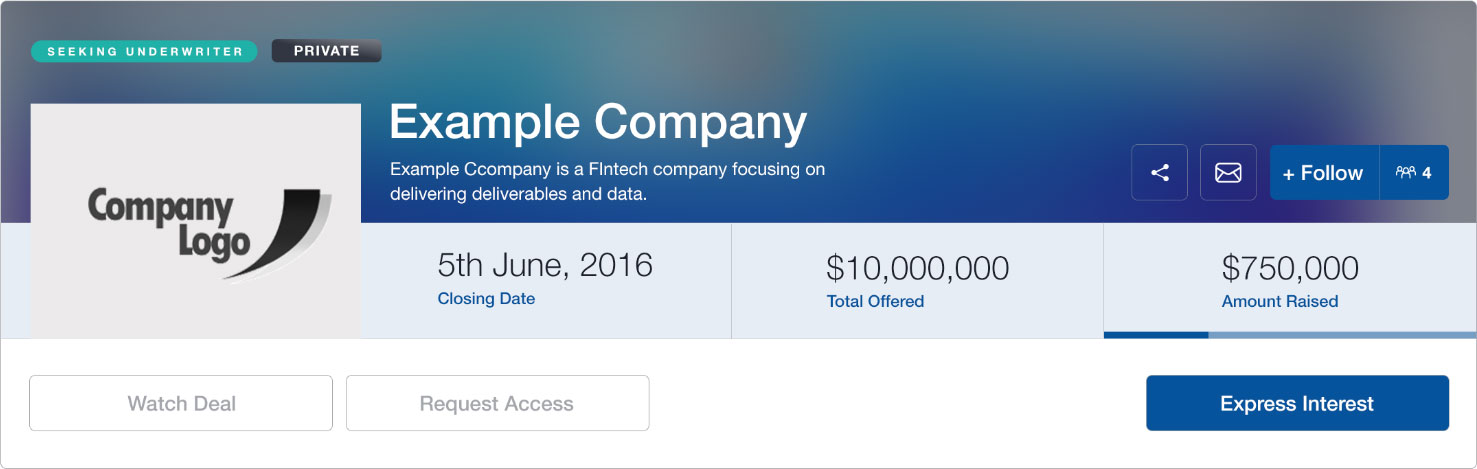

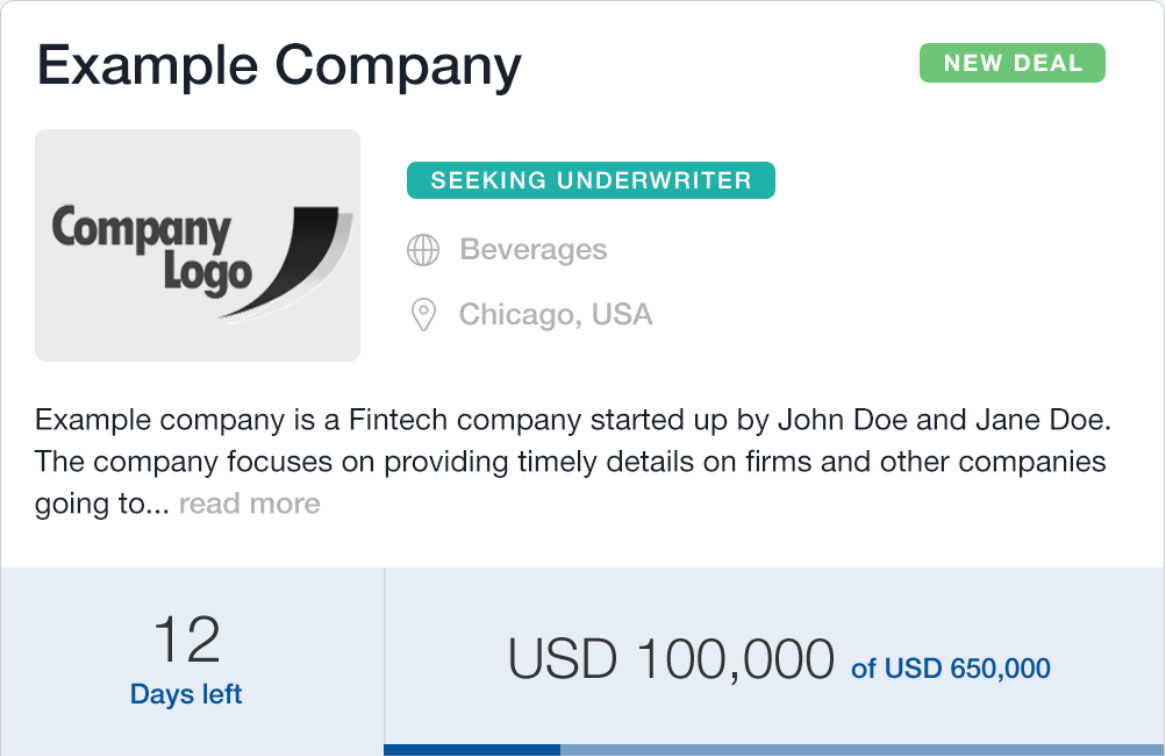

2.Manage Deal flow

Leverage CapBridge to effectively and confidentially source deals that meet your investment criteria. With CapBridge’s online tools, you can also coordinate with your team to better manage deal flow, due diligence and transactions, all within an integrated environment.

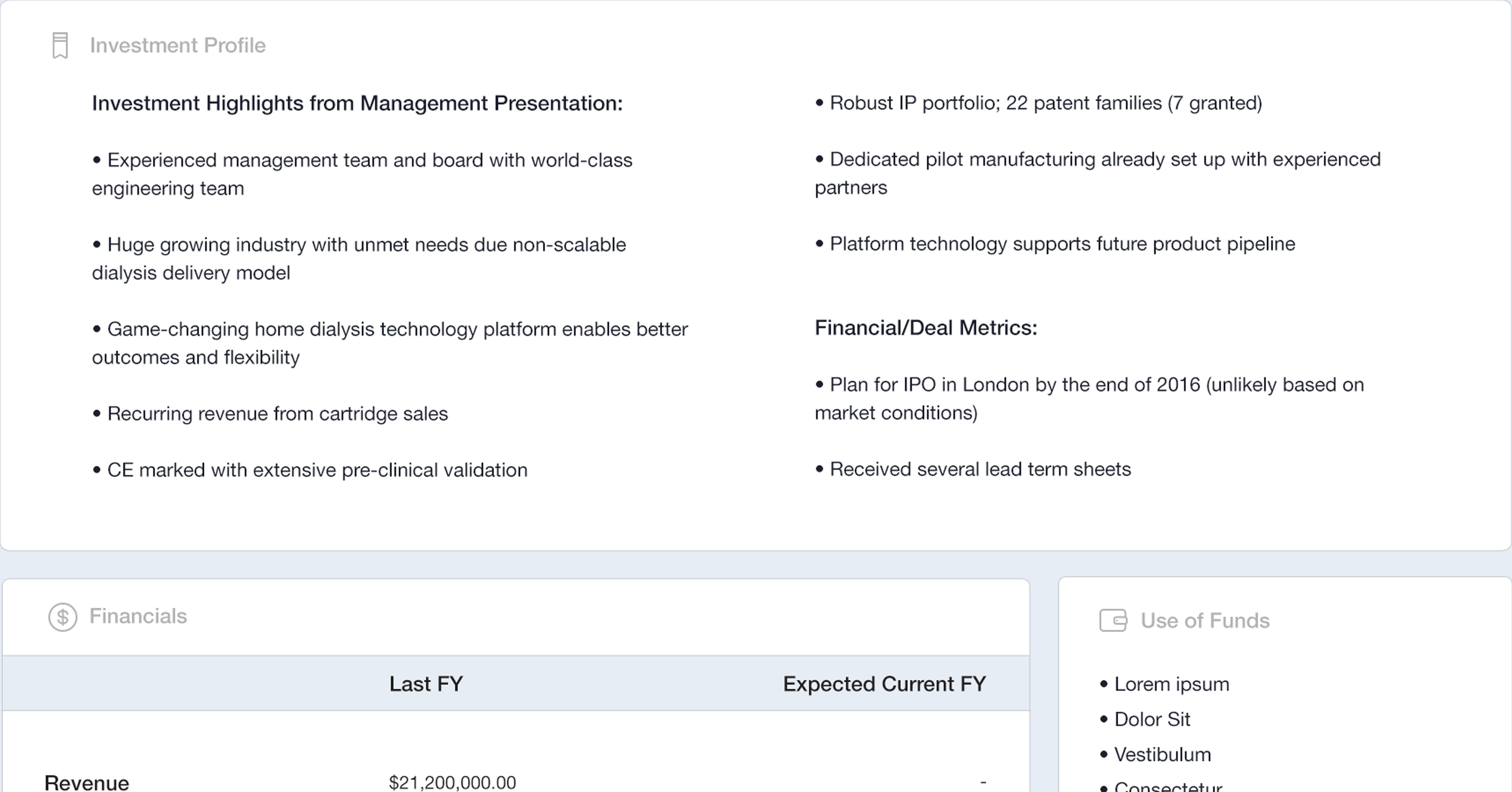

3.Conduct Due Diligence

All investments are made on the same terms as the Lead investor.

You could request access to the company’s data room, review investment terms, ask questions and interact with the company's management.

4.Complete Investment

Payment transfer details and legal documents will be provided to complete the transaction.

Funds are only transferred to the company when the campaign

is successfully closed. If not, funds are returned to

investors without any charge.

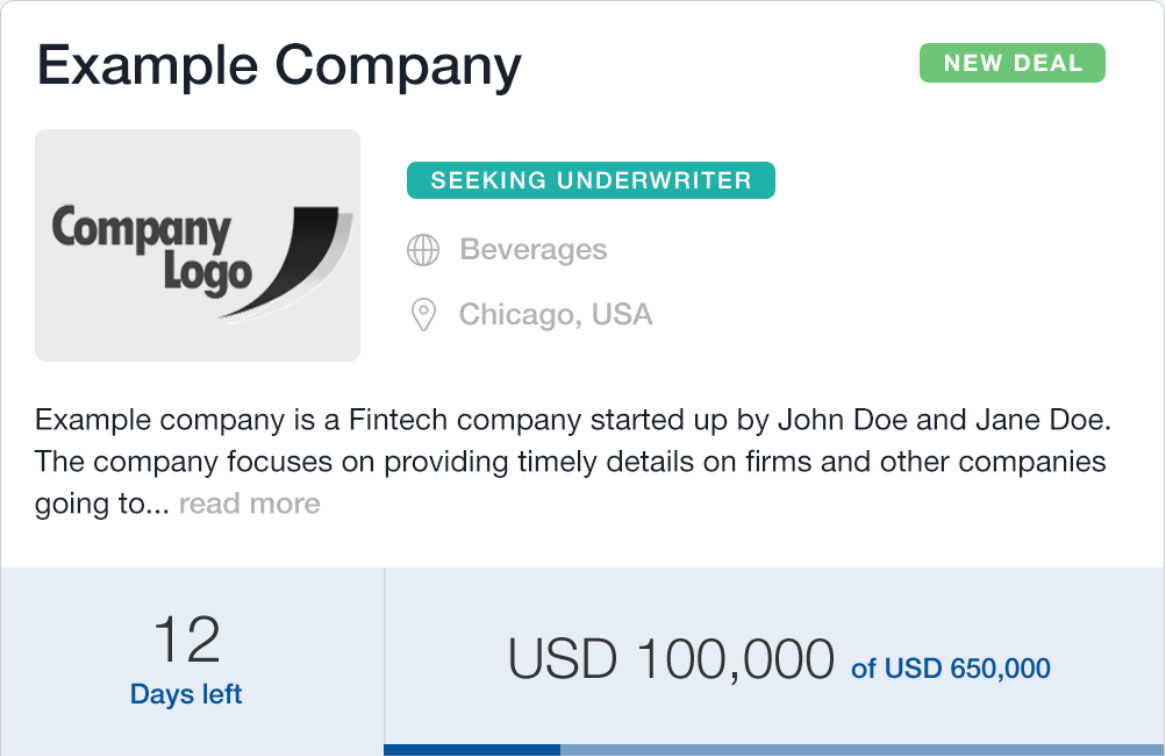

1. Create Online Profile

Create and build your online profile and share your latest updates with important stakeholders. Add a concise company overview and detailed team information.

2.Apply to Transact

You would need a term sheet from a Lead investor who will set the deal terms and valuation. Leads are either professional investors (such as VC / PE firms) or underwriters.

If you do not have a Lead investor, you may also access CapBridge's community to find suitable Lead investors.

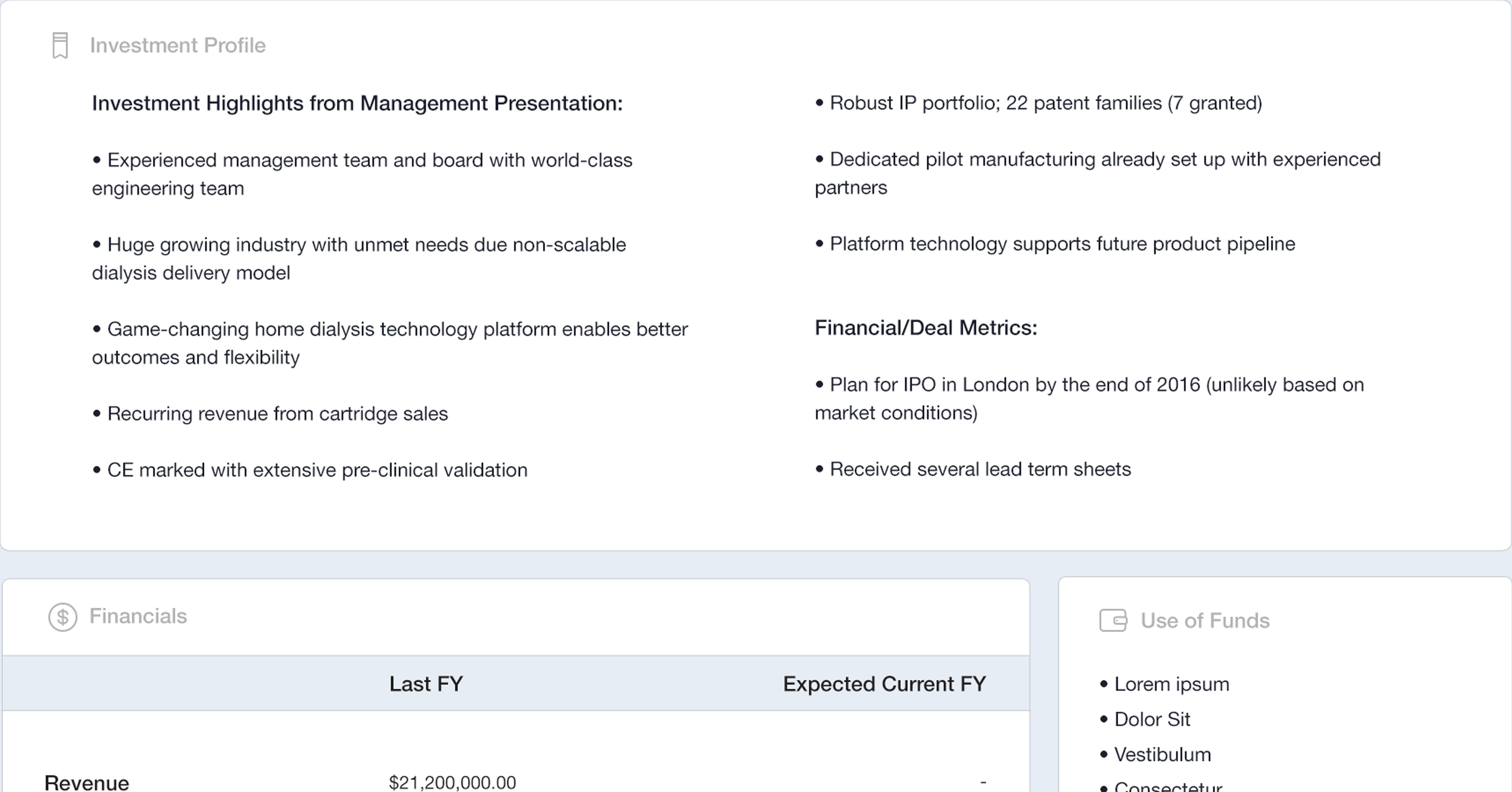

3.Investor Selection & Allocation

Once a campaign starts, you are able to selectively allow investors access to your data room and confidential information. In addition, you can control your company's shareholdings by choosing suitable investors.

4.Close Investment

Once the target amount is met, you may conclude the campaign

before the designated deadline. After the securities are issued and all

legal documents are executed, funds will then be transferred to your

company's bank account.